Paying income taxes can be a real nightmare for some, but we all pay taxes in one form or another. For example, when you work at your job to make money, taxes are deducted from your pay. Also, when you make purchases at stores, some percentage of the cost you pay goes towards sales tax. The same thing goes for owning property — you pay property taxes. But, how did income taxes all start?

Introduced in 1861 in the United States of America, the legal status of income taxes was unclear until 1913 when the constitution of the United States was ratified. From that time, the era of modern income tax system began. However, the resulting income tax system has changed a lot since 1913.

Among the many the things that changed, was the date for submitting your taxes. This day was originally on March 1, but in 1955 it was moved to April 15, and it has remained that day ever since then. If April 15 falls on a weekend, such as this year, or a civic holiday, the deadline is extended to the next working day.

This is why on April 18 you’ll hear everyone groaning about filing their taxes. Why? Because every year before that day, everyone has to report their income to the IRS by filling out any number of unique, complex, and special tax forms. You need to inform the IRS of all the income you’ve received in the previous fiscal year. And since paying your taxes is a civic duty, you’re obliged to do it.

And this is where the IRS steps in. The IRS (Internal Revenue Service) can audit any organization’s or individual’s accounts and financial data to ensure information is reported correctly. The data needs to follow certain tax laws so the IRS can verify that the reported amounts are correct.

What Do You Need To Provide?

If they need to look into your tax return, the IRS will send you a request for the specific tax documents and forms they’ll need. To speed up and enhance the IRS examination process, an electronic information management system was introduced. Getting those accounting records in the electronic format provides numerous advantages, such as:

- Reduced stress since taxpayers won’t have to print up every single file as everything is provided and filed electronically.

- Decreasing the number of items included in a document and follow-up requests as everything is already sent.

- Increasing efficiency, speed and effectiveness of the examiner’s analysis of your records.

How To Organize Your Documents

The tricky part, though, is how to properly organizing your own records and books. With a good organization system, for example, that categorizes by year and type of income or expense, you’ll speed up the IRS examination process and possibly prevent any errors or misunderstandings.

When you have a large amount of PDF tax file information you need to send that have details which you don’t need to share, you can remove that data by redacting it. Sometimes people make the mistake of trying to cover up information like a social security number or other information they feel aren’t related to an IRS audit by using different, makeshift methods, which can quickly lead to a redaction fail.

The only way to properly redact a PDF document is with a redaction tool that can be found in comprehensive PDF software. Such tools don’t just cover up your text, numbers and images, it essentially replaces the selected content with a different type of redaction fill. And this is where Able2Extract’s redaction feature can step in and save your time and your nerves.

What Is PDF Redaction?

Redaction is the process of permanently removing any PDF content (text, numbers, images) from your PDF documents. This is one of the safest ways you can secure your highly sensitive information within the document itself that no one else need to see. PDF redaction will replace a word, a line of text, or even whole section of a paragraph, with a black area or a custom colored box. With this feature, Able2Extract Professional 11 will help you prevent your confidential data from being viewed.

How To Redact With Able2Extract

You can easily blackout anything you know that isn’t necessary for anyone requesting your tax information and create a redacted tax return. In just 3 clicks you can quickly change the look of your PDF tax documents.

Step 1

Open your PDF document using the Open icon from the main toolbar. You can open both native and scanned (image) PDF documents.

Step 2

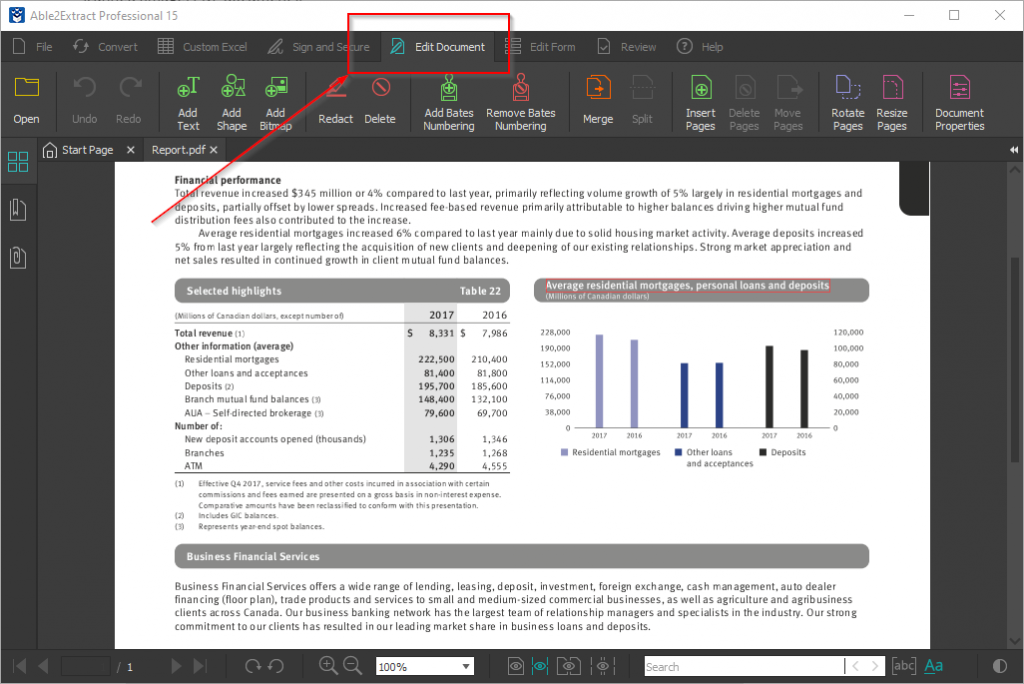

Click on the Edit Document tab to open all editing tools.

Step 3

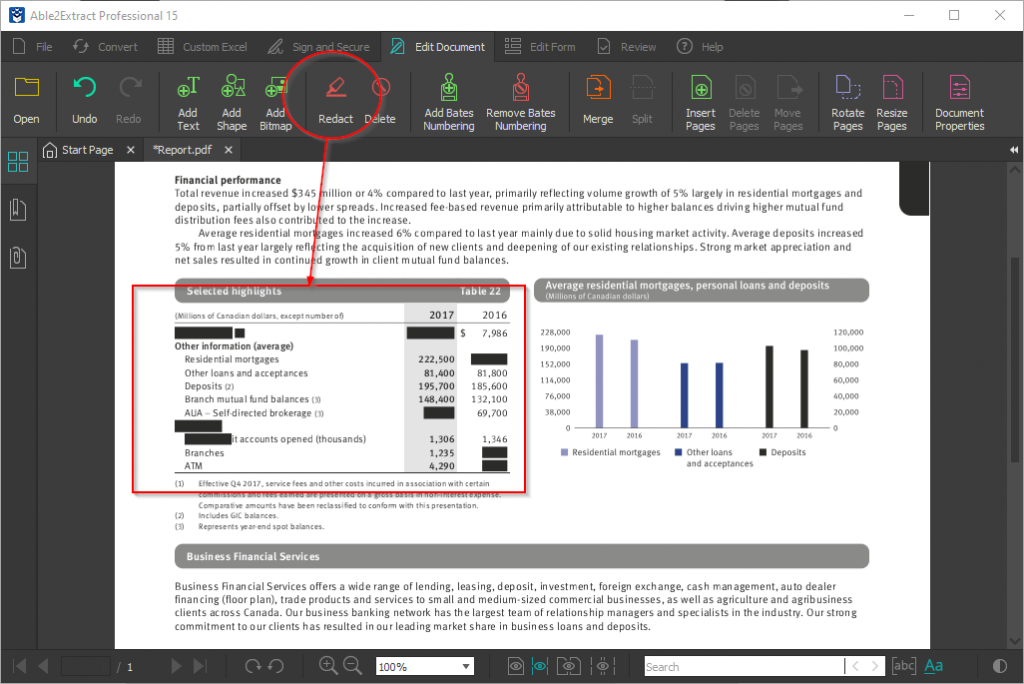

Use the Redact tool to permanently remove sensitive data from your tax PDF documents. Simply drag-select content to apply redaction.

You will redact right within the PDF viewing window.

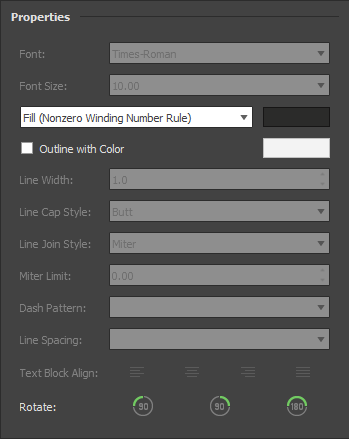

After you redact your PDF data, you can choose several options to customize your secured content in the side panel:

- Change the fill color

- Make various outline adjustments

- Rotate your data

Able2Extract’s redaction tool cannot blackout the lines that make up a table or border, but rest assured that any text, numbers, and graphics will be completely removed.

In the end, the PDF redaction tool in Able2Extract Professional can be a true lifesaver for people who work with various financial reports and different documents, regardless of profession or industry. Just by following these steps, you’ll always know that your information will be safe if the IRS knocks on your door.