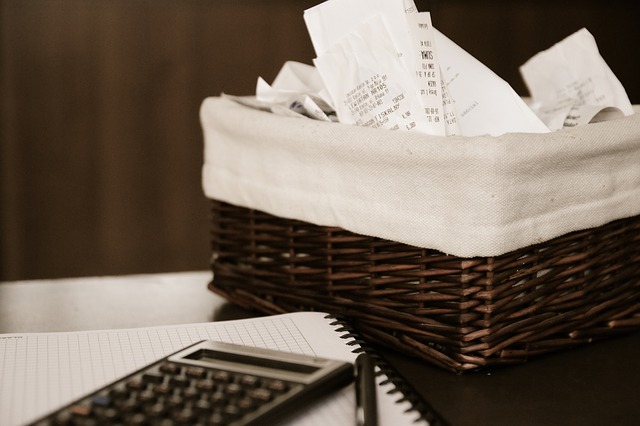

Audits, tax payments, confusing forms—just three reasons why everyone hates tax season. And though you don’t need another, you can probably think of a few more yourself. It’s hard to feel anything but dread this time of year.

Audits, tax payments, confusing forms—just three reasons why everyone hates tax season. And though you don’t need another, you can probably think of a few more yourself. It’s hard to feel anything but dread this time of year.

So you do what you can to make things easier and cheaper. But even that has its drawbacks. For instance, if you decide to cut out the accountant and the fees, you may have to do some major research to properly file a tax return on your own.

That being said, if you aren’t too tax savvy, finding answers to your questions will be the real challenge. Of course, there is the IRS website for official directions and answers, which should be on the top of your list. Yet if you need some clarification or insight, what sources do you turn to at the 11th hour?

Try and see if a few of the following sites can help boil down the essentials for you. They come well-stocked with helpful, easy-to-read articles and credible writers that have extensive experience and knowledge in the field.

H&R Block TaxTips

The Tax Tips section of the H&R Block blog covers some of the most common topics including filing status, tax deductions, and tax refunds. This blog makes sure that you have the answers to all the basic questions on filing.

Intuit Accountants

As you may know, Intuit has been providing small businesses, accountants and individuals with tax preparation tools like QuickBooks. Fortunately, the accountants that use the software are highly active in helping their clients and each other with tax questions on both the blog and the online Intuit Accountants community. Sift through them with a few keywords and you’re likely to find a thread or post that can point you in the right direction.

TurboTax Blog

The TurboTax blog is also another good starting point for tax tips. If you’re a TurboTax user, you might be going through this blog already. Topics you can find posts on include deductions, 401K, incomes and investments, home, education and a few more categories that can generate some of the most commonly asked tax questions.

About.com Tax

Because instructions and policies on filing taxes can be really confusing, a good idea is to start at the beginning. The About.com Tax section is filled with basic (and intermediate) tips for individuals, articles for business professionals, and even advice for tax preparers. There’s a good list of Tax Planning categories to explore, so you’re bound to find the answers you need.

TaxGirl.com

Unlike most of us, Kelly Pillips Erb, tax attorney and tax writer/blogger is enthusiastic about taxes—and it shows! Her blog, TaxGirl.com, and column on Forbes.com are both all about explaining and discussing tax issues as well as covering news in the industry. Her insights and articles provide a lot of perspective that can help you make well-informed tax-filing decisions.

eSmartTax.com & Liberty Tax Service

eSmartTax.com is the online division of Liberty Tax Service, a US-based tax preparation service. The site and content are easily accessible and provide you with tax related topics, discussions and resources. The main Liberty Tax Service site itself contains a good section on tax resources and posts on their Tax Lounge blog you can go through.

AccountingWeb.com

It was hard to pick one single blog from this roster, so we give you the full list. Like the Intuit Accountants community, AccountingWeb.com is a good starting point for those needing the perspective of an accountant. All writers have their credentials and fields of expertise listed, so you can determine which professional might have the answers you need.

Tax Policy Center

This one makes the list for its authoritative value. Made up of experts with years of experience in tax, budget, and social policy, Tax Policy Center is focused on bringing you information on the policies behind the taxes you file. With an official library of publications, a dedicated blog, and sections devoted to Tax Facts and Tax Topics, this site is hands down a must-visit resource.

Remember that these sites only provide you with extra information, not legal financial advice on preparing your taxes. Thus, while you may feel some anxiety about filing taxes on your own, it doesn’t mean you have to go into it unprepared.

This was a very short list for such a complex topic. If we missed one which you think should be on here, let us know by adding your own go-to resources in the comments!

Photo Credit:

Photo Credit: